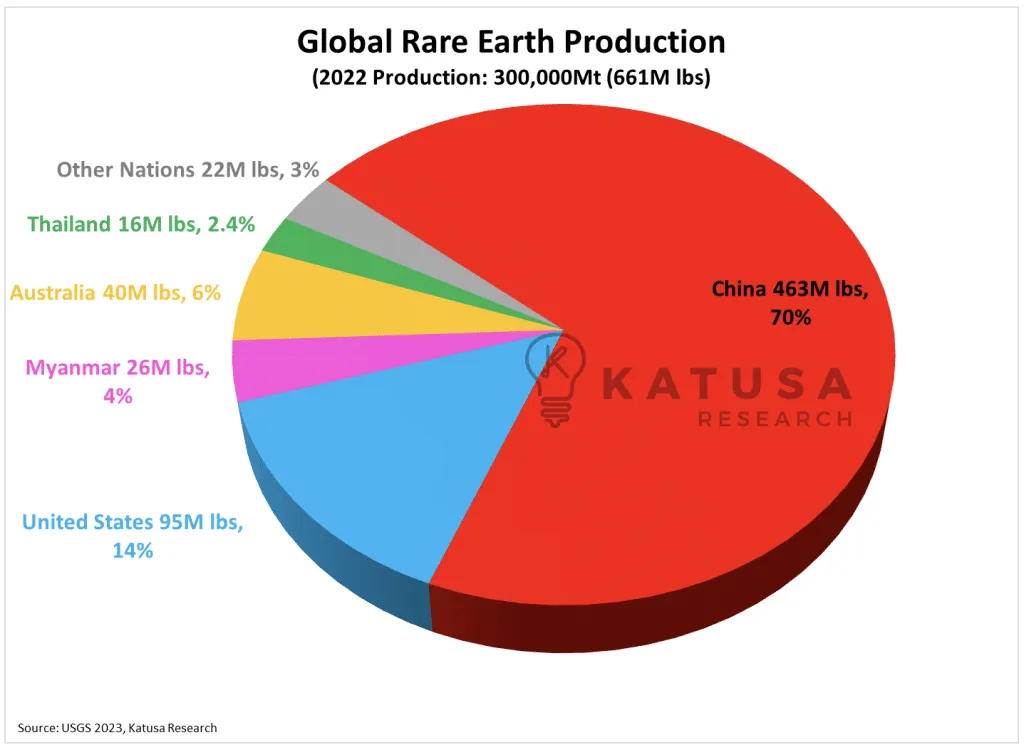

Thailand's Rare-Earth Supply Strategy and the industry are growing fast. In 2024, the country produced about 13,000 metric tons of rare earths, a sharp 261% jump from the year before. This surge signals Thailand’s bold move to build a stronger role in global critical minerals, not just by mining, but by processing and refining these valuable resources.

From Mining to High-Value Processing

Instead of focusing on raw extraction, Thailand’s Rare-Earth Supply Strategy targets downstream processing and recycling. The goal is to add value — turning minerals into magnetic materials, battery components, and industrial compounds used in clean technology and electric vehicles (EVs).

Read Also: The Strategic Integration of EV Shuttle Routes into Bangkok’s Mass Transit

At the heart of this shift is Neo Magnequench, a facility in Korat producing high-performance magnets. These magnets support Thailand’s growing EV ecosystem, which includes major Chinese automakers setting up factories in the country.

Thailand's Rare-Earth Supply Strategy: Role in the Regional Supply Web

Thailand is not acting alone. The broader Southeast Asian strategy divides rare earth roles across the region. Myanmar focuses on extraction, Vietnam on integrated production, Malaysia on refining, and Thailand on neutral processing and recycling.

This setup makes the region more resilient, reducing global dependence on any single supplier. Thailand’s neutrality — both politically and geographically — allows it to connect diverse markets without being caught in trade conflicts.

Building a Neutral Hub for Critical Minerals

In October 2025, Thailand and the United States signed a Memorandum of Understanding (MOU) focused on deepening cooperation in rare earths. The agreement promotes joint exploration, refining capacity, recycling technologies, and investment across the entire value chain.

This move reflects a larger strategy to diversify global critical mineral supply chains. The US aims to reduce dependence on dominant suppliers, while Thailand gains foreign investment, technology sharing, and a stronger global profile.

The MOU also highlights Thailand’s diplomatic balance — strengthening ties with the US while maintaining close economic links with China, its largest trading partner. By staying neutral, Thailand offers a stable and trusted hub amid geopolitical tensions.

Sustainable Growth and Long-Term Vision

Thailand’s approach is not only about expansion but also about sustainability. The country’s rare earth projects emphasize environmental compliance and clean technology, setting a contrast with traditional mining-heavy models seen elsewhere.

Foreign investors are drawn to Thailand’s eco-conscious strategy, which aligns with global trends toward greener supply chains. With a projected 7.91% annual growth rate in rare earth production from 2025 to 2030, Thailand is poised for steady and responsible growth.

Why Thailand's Rare-Earth Supply Strategy Matters

As the world races toward electrification, renewable energy, and digitalization, demand for rare earth materials continues to rise. Thailand’s model — combining sustainability, processing expertise, and diplomatic neutrality — offers an alternative path in a resource market often dominated by a few countries.

The nation’s clear focus on cooperation, rather than competition, gives it a distinctive advantage. By leveraging partnerships and innovation, Thailand is quietly becoming a cornerstone in Asia’s evolving critical minerals landscape.

Read Also: Thailand Gold Tax Opposition Intensifies in 2025

Looking Ahead: Thailand's Rare-Earth Supply Strategy

The country's supply strategy shows that smart diplomacy and sustainable industrial planning can create new opportunities in a competitive market. Businesses exploring supply diversification or investment in critical minerals should keep an eye on Thailand’s progress. To learn more or get professional guidance on navigating this growing sector, contact Market Research Thailand, a global consulting firm experienced in strategy, investment, and industrial development.

FAQs

1. Why is Thailand focusing on rare earth processing instead of mining?

Thailand aims to add more value through processing, recycling, and magnet production rather than raw extraction.

2. What does the US-Thailand MOU involve?

It promotes cooperation in refining, recycling, and investment to diversify global rare earth supply chains.

3. How does Thailand’s approach differ from neighbors?

Thailand serves as a neutral processing hub, while Vietnam, Malaysia, and Myanmar specialize in other supply chain stages.

4. What industries benefit from Thailand’s rare earth strategy?

Electric vehicles, clean technology, and advanced manufacturing are key beneficiaries.

5. How can companies explore Thailand’s rare earth opportunities?

They can reach out to Market Research Thailand for expert guidance on investment and strategic planning in Thailand's Rare-Earth Supply Strategy.