Thailand is entering a new era of wealth management. With a fast-rising millionaire population and major policy reforms, the country is becoming a hub for global family offices. At the heart of this transformation is the Thailand generational wealth shift, driven by demographics, inheritance dynamics, and investor-friendly regulations.

Thailand Generational Wealth Shift: Millionaire Growth Reshaping the Landscape

Thailand’s millionaire population is projected to grow by 24% by 2028, from 100,001 to 123,531 individuals. This pace puts the country among the top ten worldwide for millionaire growth, even ahead of several advanced economies.

Such rapid expansion signals more demand for wealth management services, particularly family offices. These organizations, which manage the assets and succession planning of wealthy families, are becoming central to Thailand’s financial ecosystem.

Generational Shifts and Wealth Transfers

Globally, around $83 trillion will transfer between generations in the next two decades. Thailand is no exception. Much of this wealth will first move horizontally between spouses before reaching the next generation. With women’s longer life expectancy, female wealth ownership in Thailand is set to rise.

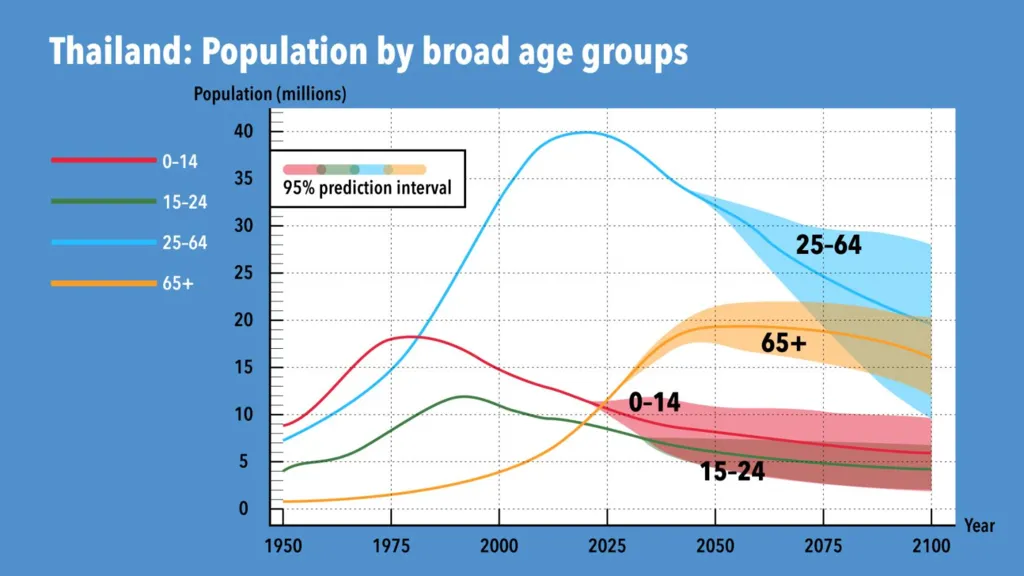

Demographics further accelerate this trend. By 2030, more than 21% of Thailand’s population will be over 65. This aging society ensures intergenerational transfers will become more frequent, driving demand for structured succession planning and professional family office services.

Read Also: Digital-First Shift Ignites Thailand’s Insurtech Boom: Youth, Tech, and Trust

The Rise of Family Offices and Thailand Generational Wealth Shift

Family offices are multiplying worldwide, with Asia now home to 9% of all family offices globally. Growth is especially strong in Southeast Asia, where new wealth and changing family dynamics are fueling demand.

Thailand’s growing pool of high-net-worth individuals and entrepreneurs makes it an attractive market. Family offices here not only manage inheritance and tax planning but also increasingly explore new investment strategies. Globally, family offices are allocating more funds into venture and growth capital, reflecting a shift from traditional investments to opportunities in technology, healthcare, and green industries. This mindset is gaining traction in Thailand as well.

Reforms and Immigration Schemes Attracting Wealth

Government policy plays a major role in shaping Thailand’s wealth management future. The Long-Term Resident (LTR) visa program is a standout example. By the end of 2024, more than 6,000 visas had been issued, with a target of one million wealthy foreign residents over the next five years. The program offers flexible investor categories, easing the path for affluent individuals to settle and invest in Thailand.

Regulation is also evolving. The Securities and Exchange Commission of Thailand has relaxed licensing rules for digital asset fund management. This allows traditional asset managers to expand into cryptocurrencies and blockchain investments, appealing to younger and tech-savvy investors.

Meanwhile, the phased adoption of Basel III banking reforms by 2028 will strengthen financial stability, reinforcing confidence among global investors considering Thailand as a base for wealth management.

Why Thailand Is Becoming a Wealth Hub

Thailand’s strengths lie in its combination of rapid wealth growth, demographic shifts, and policy reforms. The surge in millionaires creates demand for sophisticated wealth planning. The aging population accelerates generational transfers. Investor immigration schemes and regulatory modernization attract both domestic and foreign wealth.

As the Thailand generational wealth shift unfolds, family offices are positioned to play a central role. They will guide families through succession planning, investment diversification, and long-term wealth preservation.

Read Also: Thailand QR Cross-border Payments Connect ASEAN, Inclusion Ahead!

Looking Ahead: Thailand Generational Wealth Shift

Thailand is not just experiencing a rise in wealth; it is reshaping how that wealth is managed. With record growth in high-net-worth individuals, a massive intergenerational transfer ahead, and investor-friendly reforms, the nation is evolving into a key hub for family offices in Asia. For wealthy families and investors, the time to explore opportunities in Thailand Generational Wealth Shift is now.

FAQs

1. What is driving Thailand’s generational wealth shift?

Rising millionaire numbers, aging demographics, and global inheritance transfers are reshaping wealth ownership.

2. How fast is Thailand’s millionaire population growing?

It is expected to rise by 24% between 2023 and 2028.

3. What role do family offices play in Thailand?

They help wealthy families with succession planning, investments, and intergenerational wealth transfer.

4. How does the LTR visa support wealth management?

It attracts wealthy foreign residents by offering investor-friendly visa categories and residency benefits.

5. What regulatory reforms are underway?

Relaxed rules on digital asset management and the gradual adoption of Basel III banking reforms.