The Thailand food delivery market is growing fast. By 2025, it’s expected to generate over US$5.24 billion, with an annual growth rate of about 8% through 2030. This surge reflects big shifts in how people eat, shop, and live in the digital age. Once a niche service, food delivery exploded during the pandemic. From 35 billion baht in 2019, the market jumped to over 68 billion baht in 2020. That momentum hasn’t slowed. As more consumers embrace the ease of ordering meals online, platforms are racing to win their loyalty.

Thailand Food Delivery Market Wars: Who’s Leading the Race?

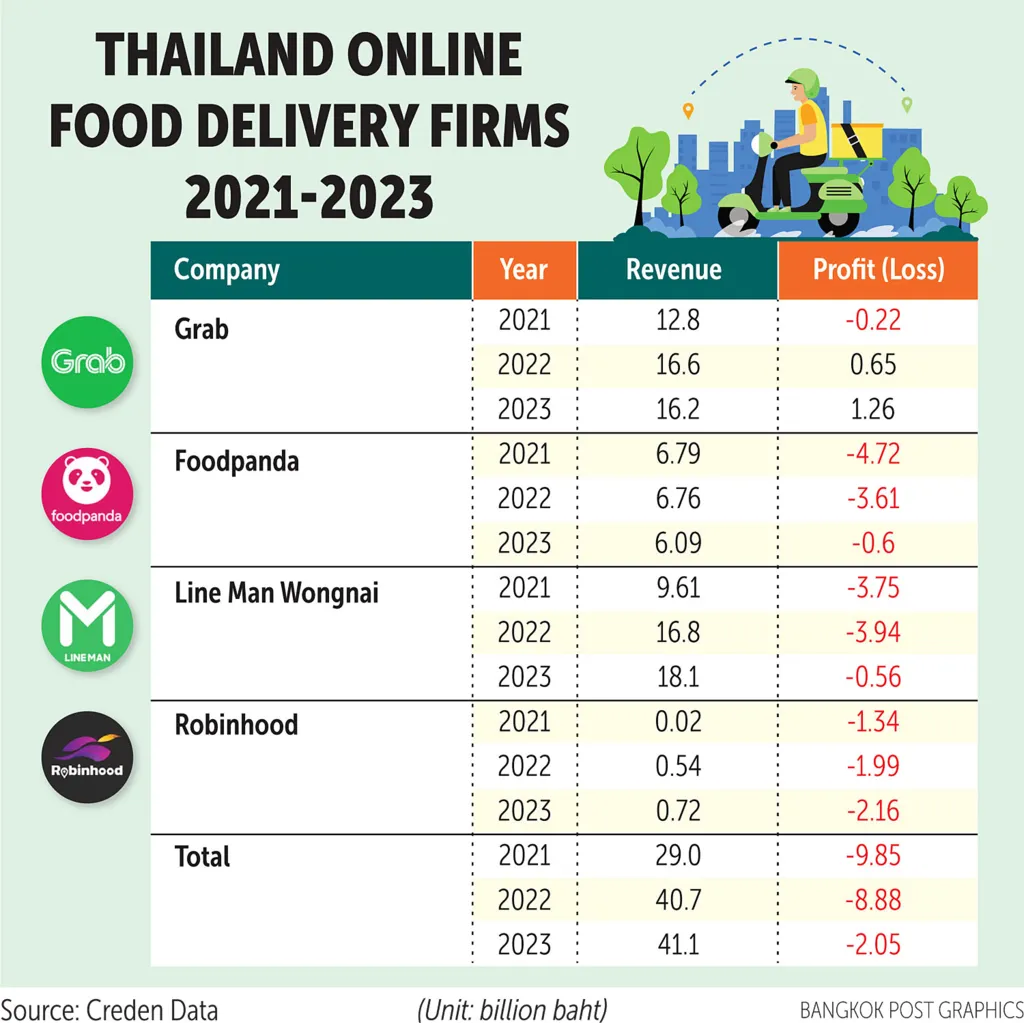

The competition among delivery apps is fierce. GrabFood, with over 32.7 million active users, remains a dominant force in Thailand and across Southeast Asia, where it holds 53.9% market share. LINE MAN, with over 1 million users, and Foodpanda, with about 74,000 active users, are also major players.

Each platform offers its own mix of rewards, fast delivery, and exclusive partnerships to stay ahead. More recently, newcomers like Robinhood and Gojek have entered the scene, betting on hyper-local services and affordable pricing to attract customers.

Changing Consumer Behavior Affects Thailand Food Delivery Market

Today’s Thai consumers aren’t just looking for convenience. They also want to have healthier options. Around 65% of Thais identify as flexitarians, meaning they occasionally choose plant-based meals. In response, food delivery platforms and restaurants are adding more vegetarian and health-conscious choices to their menus.

Another big trend is the rise of cloud kitchens, or delivery-only kitchens with no dine-in space. These businesses are growing at a CAGR of 26% from 2024 to 2029. Cloud kitchens let brands expand quickly and meet customer demand for fast, affordable, and diverse food options. For small or home businesses that are just starting out, this option opens up a new door to reach more people easily.

Economic Shifts and Digital Adoption

Thailand’s broader foodservice market, valued at USD 35.4 billion in 2025, is forecasted to grow to USD 51.4 billion by 2030, showing the sector’s overall strength. Within that, quick service restaurants (QSRs) hold a 51% market share, driven by the popularity of fast food and the ease of delivery integration.

Economic concerns like household debt and inflation do influence spending. But even budget-conscious customers still look for value and experience—a tasty meal, fast delivery, or exclusive app perks.

Read Also: Thailand Digital Banking Landscape Reshaping the Sector

The high internet penetration rate (~78%) and widespread smartphone use are also key. These digital tools allow users to browse, compare, and order meals in seconds, pushing platforms to innovate constantly.

Read Also: Thailand Urban Renewal Projects: Breathing New Life into Cities

What’s Next for Thailand’s Food Delivery Market?

As tourism rebounds and digital habits deepen, Thailand food delivery market will continue to expand. Platforms will compete not just on price, but also on menu variety, health options, delivery speed, and user experience. For investors and businesses, the message is clear: this is a high-growth sector fueled by tech, taste, and convenience. With strong demand, evolving consumer needs, and a competitive landscape, the future of food delivery in Thailand looks anything but ordinary.